Invoice Discounting and Retail Investors

Invoice Discounting and Retail Investors

The availability of working capital helps businesses generate and grow revenues and profits. Cash flow is a crucial component of optimal working capital management. Companies require cash for daily activities spanning inventory purchases, salary and rent payments, etc.

When one business (Seller) supplies goods or services to another (Buyer), it obviously would like to be paid up front, while the Buyer prefers paying later as it has to manage its own working capital. Invoice discounting helps in these scenarios.

What is Invoice Discounting?

In such a situation, the Seller would approach institutions like Banks and Non-banking Financial Companies to get cash against the invoice. After validating the invoice itself and the Buyer-Seller relationship history, these institutions would offer cash against the invoice amount for a cost (discounting charges). On the payment due date, the Buyer directly paid the invoice amount to these institutions and the transaction closed.

Invoice Discounting as an asset class has existed for decades, if not centuries, but investments in it were limited to Banks and structured financial institutions.

Invoice Discounting on UpCap

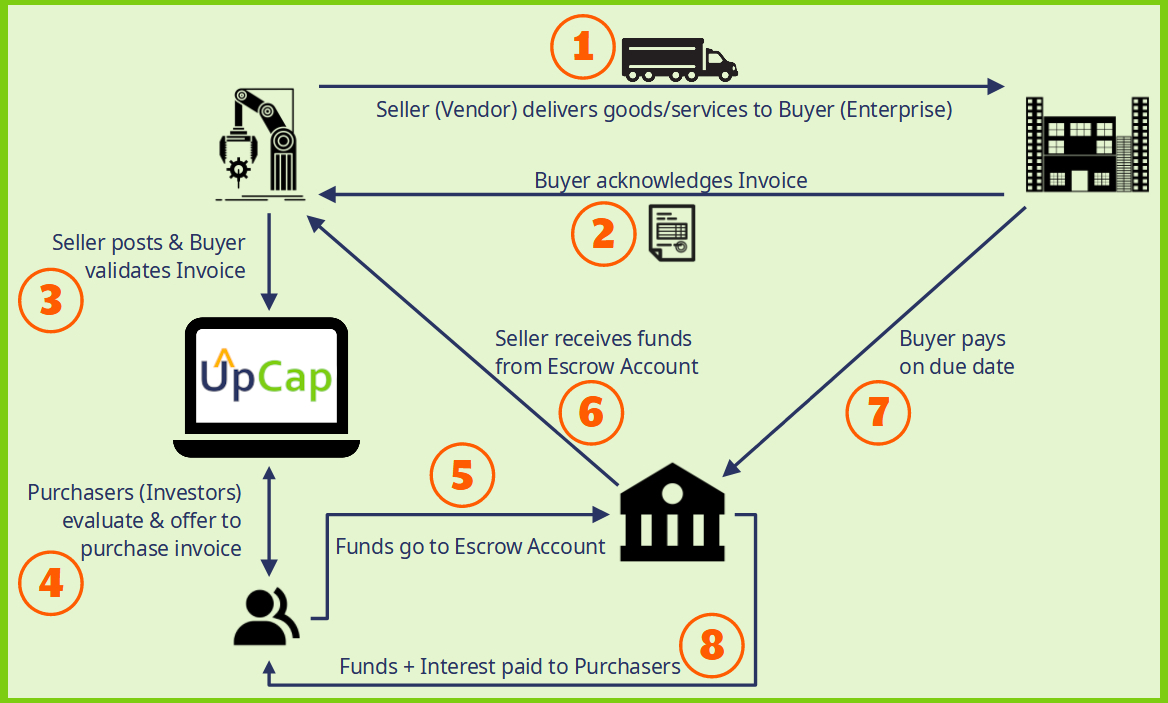

As a Fintech Platform, UpCap allows Sellers to post invoices for discounting. Buyers, also on the platform, confirm that the invoice has not been discounted elsewhere and their commitment to pay on the due date.

UpCap maintains a comprehensive database of financial information about Sellers, Buyers, their relationship and credit history. Investors on the platform can view the available invoices along with the credit scores. When you fund an invoice, fund transfers occur through a dedicated Escrow Account. When the invoice payment falls due, the Buyer deposits it in the Escrow Account from which appropriate amounts are disbursed to the investor or investors who funded the invoice.

This is how a typical transaction might occur:

- A has sold goods worth ₹1,00,000 to B and raised an invoice. B's payment terms are 60 days.

- A posts the invoice on UpCap and B confirms its validity.

- UpCap investors evaluate the invoice, ratings of A and B, and the yield offered.

- Investors transfer funds to A through a trustee-supervised Escrow Account.

- After 60 days, B pays the invoice amount into the Escrow Account.

- The invested amount is returned to investors along with the yield.

Why should Retail Investors consider Invoice Discounting?

With the emergence of Fintech platforms in India, invoice discounting has become attractive to a wider spectrum of investors including individuals. As an alternate investment option, invoice discounting appeals due to the following factors:

- Short investment tenure: Unlike long term investments in which funds are blocked for a relatively long period, invoice discounting offers investor flexibility as it is a short-term instrument with tenure ranging from 30 days to 6 months.

- Minimal risk: Invoice discounting in essence is the right to receive the invoice amount against an invoice that is verified and validated, thereby ensuring that risk is minimized for the investor. Thorough due diligence of Buyer & Seller can enhance the overall credibility of the investing process.

- Higher than Market Returns: Annualized returns in invoice discounting range between 11% to 14% in the short term which is approximately 2 times higher than short term bank FD/ savings account rates. It is also higher compared to Debt MFs and Gold or metals over a short-term horizon.

- No Market Dependency: Returns are determined at the time of deal inception; there are no market fluctuations at play. This ensures predictibility and stability.

- Minimal Investor Effort: Investors do not have to monitor anything once an invoice has been funded by them, unlike other market driven options that demand frequent, if not constant, attention to be paid over time.

- Flexibility of Investment: Invoice discounting lets investors invest whenever they have surplus funds - neither the periodicity nor the amount is fixed. Individuals can therefore exercise this investment option without worrying about a periodic investment obligation.

- K Chetana, Sep 2022

Return to Finsight Offerings